Featured 1

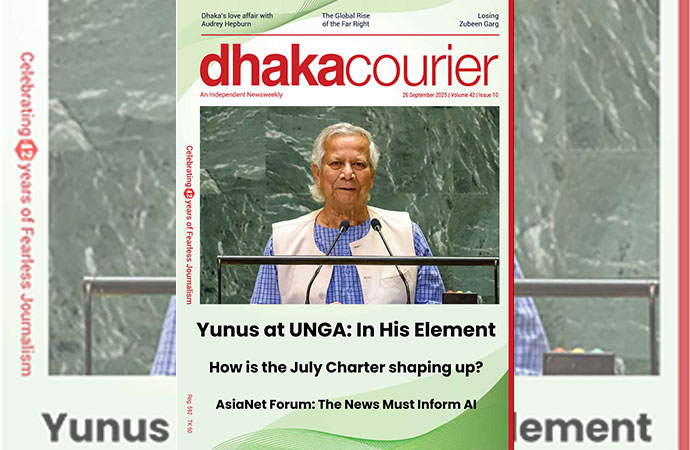

Chief Adviser Dr Muhammad Yunus. Photo: Collected

Alongside maintaining internal security, managing the economy to maintain its growth trajectory when many predicted a recession following the Uprising, stood out as possibly the toughest challenge ahead of the interim administration led by Dr Muhammad Yunus, as it took charge of Bangladesh a year ago, in those extraordinary circumstances occasioned by the July Uprising.

The overnight collapse of an entrenched, overbearing and indeed authoritarian government that had nevertheless ensured robust growth rates in terms of GDP over the length of its three-and-a-bit terms, obviously led to some loss in investor confidence. Political turmoil, whether essential or not, is never the friend of economic stability. But as the speakers at a discussion organised by the Centre for Policy Dialogue, or CPD, one of the country's leading think tanks, recognised this week, the fact that the economy has remained stable, despite enduring curfews and an almost Covid-like shutdown for a period during the Uprising, can be attributed to some sound economic policymaking by the interim administration.

The credit for that largely goes to the Chief Adviser's two best picks - at least in our judgement - when picking the members of his new team: they are Dr Salehuddin Ahmed as adviser to the Ministry of Finance, and Dr Ahsan Mansur as the governor of Bangladesh Bank. Later on, the addition of Sheikh Bashiruddin as commerce adviser has also proven to be a commendable choice. A notable theme to their work has been returning a form of orthodoxy to economic decisionmaking. The AL era, by the end, became too mired in improvised, unorthodox policies, like the "9-6" interest rate spread, three different official exchange rates, and a lax attitude towards inflation, that the central bank more or less stopped concerning itself with. In the light of history, these may be revealed as worse than bad policymaking. It's possible they were pursued with more sinister objectives aligning with the preservation of a certain coterie or class of oligarchs that we saw develop around the AL regime.

Whatever the motivations may have been, undoing these unnecessary or even harmful innovations was actively pursued by Dr Yunus's team, and they have largely succeeded in this regard. Instead of restricting it within the "9-6" band, Dr Mansur has used monetary policy, i.e. the rate of interest, to try and rein in inflation - a classical measure. He has perhaps been less successful than he hoped to be, but it is undeniable that lately there has been some movement on this front, in the right direction. And there is no doubt he has stabilised the exchange rate to a large extent, by implementing another orthodox policy of stopping the sale of dollars by the central bank, which was happening at unprecedented levels under his predecessor. By doing so he has made great strides towards unifying the exchange rate again, which would be his ultimate aim.

The banking sector, which was on the road to ruin, has also been salvaged by the interim government, albeit with scars that will take longer to heal. Most importantly, now that an election date has been announced, we can already see some positive movements on the investment front, and unless something catastrophic occurs in the next six months, the next government will inherit an economy that is much better placed to deal with the challenges of the day, than the one the IG inherited itself. That can be termed as success.

Leave a Comment

Recent Posts

Religion and Politics: A Toxic ...

At Dhaka University, cafeteria workers have been told not to wear shor ...

Enayetullah Khan joins AsiaNet ...

AsiaNet’s annual board meeting and forum was held in Singapore, ...

In a New York minute

Many leaders back a UN call to address challenges to ..

Defaulted loans at Non-Bank Financial Institutions ( ..

How the late Zubeen Garg embodied cultural affinitie ..